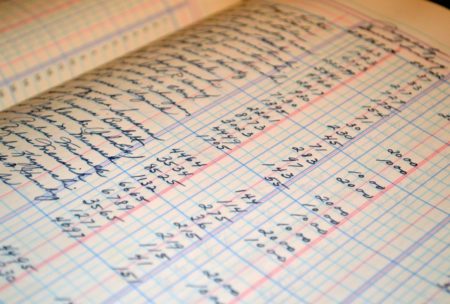

This course is designed for those interested to learn to update manual ledgers, prepare a profit and loss, balance sheet, and VAT return from manual ledger accounts.

Read more.Instructor

Lisa Newton, BA, MSc, FMAAT has a masters degree in Investment Management and a first class honours degree in Accounting with Marketing.

Access all courses in our library for only $9/month with All Access Pass

Get Started with All Access PassBuy Only This CourseAbout This Course

Who this course is for:

- Students who want to understand how manual bookkeeping is performed

What you’ll learn:

- Prepare nominal accounts manually

- Prepare a trial balance

- Prepare a balance sheet

- Prepare the VAT Return

Requirements:

- Students will need to understand double entry bookkeeping – although we will recap the principle

- Having excel or a spreadsheet program will be helpful, although not essential

- Students will need a calculator and lined paper

Manual bookkeeping covers the material equivalent to a certificate in manual bookkeeping level 2. You will need to have come across the concept of double entry bookkeeping before. On this course, we look at how to update the ledger accounts. We take these end balances on the ledgers and use them to prepare a Trial Balance. From the figures on the Trial Balance, we prepare a Balance Sheet and a Profit and Loss Account.

We also take the figures on the VAT account, make an adjustment for Bad Debts and use the figures to prepare the figures for a VAT return.

This course is useful if you want to learn more about manual bookkeeping, and also, if you want to have a better understanding of bookkeeping in general. Even if you are currently using a bookkeeping software, the knowledge gained on this course will really help you to understand what is going on ‘behind the scenes’ of the program. Software is great, because it saves us time, but if they go wrong, having a manual understanding is very helpful because then you’ll know WHY the accounts are incorrect, and how to fix it.

Our Promise to You

By the end of this course, you will have learned Manual Bookkeeping.

10 Day Money Back Guarantee. If you are unsatisfied for any reason, simply contact us and we’ll give you a full refund. No questions asked.

Get started today and learn more about Manual Bookkeeping.

Course Curriculum

| Section 1 - Manual Ledgers | |||

| Introduction To The Manual Bookkeeping Course And Your Tutor | 00:00:00 | ||

| Behind The Scenes – How Bookkeeping Works | 00:00:00 | ||

| Manual Bookkeeping Booklet | 00:00:00 | ||

| Prepare The Sales Ledger Control Accounts | 00:00:00 | ||

| Prepare The Purchase Ledger Control Accounts | 00:00:00 | ||

| Prepare A Journal Entry To Write Off A Bad Debt | 00:00:00 | ||

| Update The Cashbook | 00:00:00 | ||

| Prepare The Bank Reconciliation | 00:00:00 | ||

| Prepare A Trial Balance | 00:00:00 | ||

| Post The Transactions From The Sales Day Book – Starting Opening Balances | 00:00:00 | ||

| Post The Transactions From The Sales Day Book | 00:00:00 | ||

| Post The Transactions From The Purchases Day Book | 00:00:00 | ||

| Post The Transactions From The Bank Into The Sales Ledger And Purchase Ledger | 00:00:00 | ||

| Balance Off The Accounts – Sales & Purchase Ledgers | 00:00:00 | ||

| Balance Off All The Ledger Accounts | 00:00:00 | ||

| Enter Bank Transactions Into The Ledger Accounts | 00:00:00 | ||

| Complete Vat, Sales, Sales Return, Purchases And Purchase Return Ledgers | 00:00:00 | ||

| Balance Off All Ledger Accounts | 00:00:00 | ||

| Create A New Trial Balance | 00:00:00 | ||

| Adding Up The Debtors And Creditors Ledger | 00:00:00 | ||

| Prepare A Trial Balance As At 31 March | 00:00:00 | ||

| Section 2 - Balance Sheet and VAT Reporting | |||

| Prepare The Balance Sheet | 00:00:00 | ||

| Balance Sheet Terms | 00:00:00 | ||

| Write Up The Vat Account | 00:00:00 | ||

| Prepare The Vat Return | 00:00:00 | ||

| Section 3 - Recap and Next Steps | |||

| Manual Recap And Where To Go From Here | 00:00:00 | ||

| Manual Next Steps | 00:00:00 | ||

VERY HELPFUL

I love the step-by-step and the answer sheet it is helping guide me for my own financial information for my new business, I didn’t know where to start, and now I know what to keep track of and how to document it correctly!

Manual Bookkeeping

I enjoyed learning something new every day. I learned a lot from this course and will like to learn more courses from Lisa.

Awesome Course!

Great job, it was definitely a lot of knowledge to retain which I appreciate. I am new to learning bookkeeping so I will retake this course again to let all that good info soak in.

GREETINGS AND BLESSINGS... FROM THE AMERICA'S HEART!!! EL SALVADOR!!!

GREAT MASTER… CLASS!!!

THANK YOU FOR YOUR WAY OF TEACHING…

MANUAL BOOKKEEPING!!!

IT IS INTERESTING TO LEARN FROM EXPERTS LIKE YOU.

YOUR EXPLANATIONS ARE SIMPLE, ACCURATE AND TO THE POINT…

THANKS AGAIN FOR SHARING YOUR KNOWLEDGE AND EXPERIENCE!!!

ALL OF YOUR SUGGESTIONS AND RECOMMENDATIONS MUST BE TAKEN INTO ACCOUNT.