Master tax strategies for a secure financial future with our class on Taxable and Non-Taxable Income. Enroll now for comprehensive insights! Read more.

Robert (Bob) Steele CPA, CGMA, M.S. Tax, CPI

Access all courses in our library for only $9/month with All Access Pass

Get Started with All Access PassBuy Only This CourseAbout This Course

Who this course is for:

- Finance professionals

- Business owners

- Accounting professionals

What you’ll learn:

- Understand the intricacies of taxable and non-taxable income

- Navigate the income section of the tax equation seamlessly

- Identify and categorize items for and against taxable income

- Master tax formulas using Excel and advanced tax software applications

- Practical application through real-world examples and tax forms

Requirements:

- No prior knowledge necessary

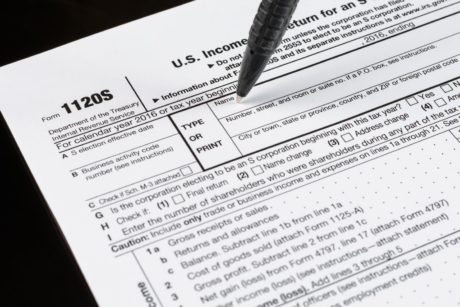

The course goes beyond theory, offering practical application through real-world examples and tax forms. This ensures a hands-on experience with Microsoft Excel and cutting-edge tax software, allowing you to apply your knowledge in a dynamic and applicable manner.

Through interactive exercises and comprehensive case studies, you’ll gain a holistic understanding of tax preparation. Engage in practical scenarios that simulate actual tax workflows, enabling you to navigate complexities with confidence. The incorporation of real-world examples ensures you not only grasp theoretical concepts but also develop the skills necessary to address practical challenges in tax preparation.

This immersive learning experience empowers you to excel in various income tax scenarios. Upon completion, you’ll be well-equipped to confidently handle tax preparation workflows, applying your expertise to address diverse income tax challenges. Gain a deeper insight into the intricacies of the income tax equation, enhancing your ability to identify and analyze items impacting taxable income. This comprehensive approach prepares you for success, whether you are a professional looking to enhance your skills or someone entering the field of tax preparation.

If you enjoyed this class, you can find out more in My Profile here om Skill Success!

Our Promise to You

By the end of this course, you will have learned about taxable and non-taxable income.

10 Day Money Back Guarantee. If you are unsatisfied for any reason, simply contact us and we’ll give you a full refund. No questions asked.

Enhance your skills, navigate tax preparation workflows, and excel in tax preparation with our comprehensive course.

Course Curriculum

| Section 1 - Introduction | |||

| Income | 00:00:00 | ||

| Income Reporting Forms | 00:00:00 | ||

| Income Recognition Concepts | 00:00:00 | ||

| Section 2 - W-2 Income | |||

| W-2 Income | 00:00:00 | ||

| Tax Software Example W-2 Income | 00:00:00 | ||

| Section 3 - Interest And Dividend Income | |||

| Interest Income | 00:00:00 | ||

| Tax Software Example Interest Income | 00:00:00 | ||

| Dividend Income | 00:00:00 | ||

| Tax Software Example Dividend Income | 00:00:00 | ||

| Section 4 - Social Security Benefits And State Tax Refund | |||

| Income Social Security Benefits | 00:00:00 | ||

| Social Security Business | 00:00:00 | ||

| Refund From State Income Tax Part One | 00:00:00 | ||

| Refund From State Income Tax Part Two | 00:00:00 | ||

| Section 5 - Capital Gains And Other Kinds of Income | |||

| Capital Gains | 00:00:00 | ||

| Tax Software Example Capital Gains | 00:00:00 | ||

| Other Kinds Of Income | 00:00:00 | ||

| Tax Software Example Other Kinds Of Income | 00:00:00 | ||

| Section 6 - Excluded From Gross Income | |||

| Excluded From Gross Income Fringe Benefits | 00:00:00 | ||

| Section 7 - Comprehensive Problem | |||

| Introduction - Organizing Documents | 00:00:00 | ||

| Data Input Form W-2 | 00:00:00 | ||

| Data Input Form W-2 Tax Formula – Excel Worksheet | 00:00:00 | ||

| Data Input Form 1099-DIV And Form 1099-INT | 00:00:00 | ||

| Data Input Form 1099-DIV And Form 1099-INT Tax Formula - Excel | 00:00:00 | ||

| Data Input Form 1099-B Proceeds From Broker And Exchange Transactions | 00:00:00 | ||

| Data Input Form 1099-B Proceeds From Broker And Exchange Transactions - Excel | 00:00:00 | ||

| Data Input State Refund, Unemployment, And Winnings | 00:00:00 | ||

| Data Input State Refund, Unemployment, And Winnings Formula – Excel Work | 00:00:00 | ||

About This Course

Who this course is for:

- Finance professionals

- Business owners

- Accounting professionals

What you’ll learn:

- Understand the intricacies of taxable and non-taxable income

- Navigate the income section of the tax equation seamlessly

- Identify and categorize items for and against taxable income

- Master tax formulas using Excel and advanced tax software applications

- Practical application through real-world examples and tax forms

Requirements:

- No prior knowledge necessary

The course goes beyond theory, offering practical application through real-world examples and tax forms. This ensures a hands-on experience with Microsoft Excel and cutting-edge tax software, allowing you to apply your knowledge in a dynamic and applicable manner.

Through interactive exercises and comprehensive case studies, you’ll gain a holistic understanding of tax preparation. Engage in practical scenarios that simulate actual tax workflows, enabling you to navigate complexities with confidence. The incorporation of real-world examples ensures you not only grasp theoretical concepts but also develop the skills necessary to address practical challenges in tax preparation.

This immersive learning experience empowers you to excel in various income tax scenarios. Upon completion, you’ll be well-equipped to confidently handle tax preparation workflows, applying your expertise to address diverse income tax challenges. Gain a deeper insight into the intricacies of the income tax equation, enhancing your ability to identify and analyze items impacting taxable income. This comprehensive approach prepares you for success, whether you are a professional looking to enhance your skills or someone entering the field of tax preparation.

If you enjoyed this class, you can find out more in My Profile here om Skill Success!

Our Promise to You

By the end of this course, you will have learned about taxable and non-taxable income.

10 Day Money Back Guarantee. If you are unsatisfied for any reason, simply contact us and we’ll give you a full refund. No questions asked.

Enhance your skills, navigate tax preparation workflows, and excel in tax preparation with our comprehensive course.

Course Curriculum

| Section 1 - Introduction | |||

| Income | 00:00:00 | ||

| Income Reporting Forms | 00:00:00 | ||

| Income Recognition Concepts | 00:00:00 | ||

| Section 2 - W-2 Income | |||

| W-2 Income | 00:00:00 | ||

| Tax Software Example W-2 Income | 00:00:00 | ||

| Section 3 - Interest And Dividend Income | |||

| Interest Income | 00:00:00 | ||

| Tax Software Example Interest Income | 00:00:00 | ||

| Dividend Income | 00:00:00 | ||

| Tax Software Example Dividend Income | 00:00:00 | ||

| Section 4 - Social Security Benefits And State Tax Refund | |||

| Income Social Security Benefits | 00:00:00 | ||

| Social Security Business | 00:00:00 | ||

| Refund From State Income Tax Part One | 00:00:00 | ||

| Refund From State Income Tax Part Two | 00:00:00 | ||

| Section 5 - Capital Gains And Other Kinds of Income | |||

| Capital Gains | 00:00:00 | ||

| Tax Software Example Capital Gains | 00:00:00 | ||

| Other Kinds Of Income | 00:00:00 | ||

| Tax Software Example Other Kinds Of Income | 00:00:00 | ||

| Section 6 - Excluded From Gross Income | |||

| Excluded From Gross Income Fringe Benefits | 00:00:00 | ||

| Section 7 - Comprehensive Problem | |||

| Introduction - Organizing Documents | 00:00:00 | ||

| Data Input Form W-2 | 00:00:00 | ||

| Data Input Form W-2 Tax Formula – Excel Worksheet | 00:00:00 | ||

| Data Input Form 1099-DIV And Form 1099-INT | 00:00:00 | ||

| Data Input Form 1099-DIV And Form 1099-INT Tax Formula - Excel | 00:00:00 | ||

| Data Input Form 1099-B Proceeds From Broker And Exchange Transactions | 00:00:00 | ||

| Data Input Form 1099-B Proceeds From Broker And Exchange Transactions - Excel | 00:00:00 | ||

| Data Input State Refund, Unemployment, And Winnings | 00:00:00 | ||

| Data Input State Refund, Unemployment, And Winnings Formula – Excel Work | 00:00:00 | ||